by schmidt1 | Feb 14, 2020 | Property Tax News

“Christopher Berry, academic director for the Center for Municipal Finance and one of the study’s authors, said it’s unfortunate that the reappraisal did not fix the overassessments.

‘After having studied a lot of jurisdictions around the country, Detroit is not the only place that has this problem. But it is one of the worst that I’ve seen,’ Berry said.”

by schmidt1 | Feb 14, 2020 | Property Tax News

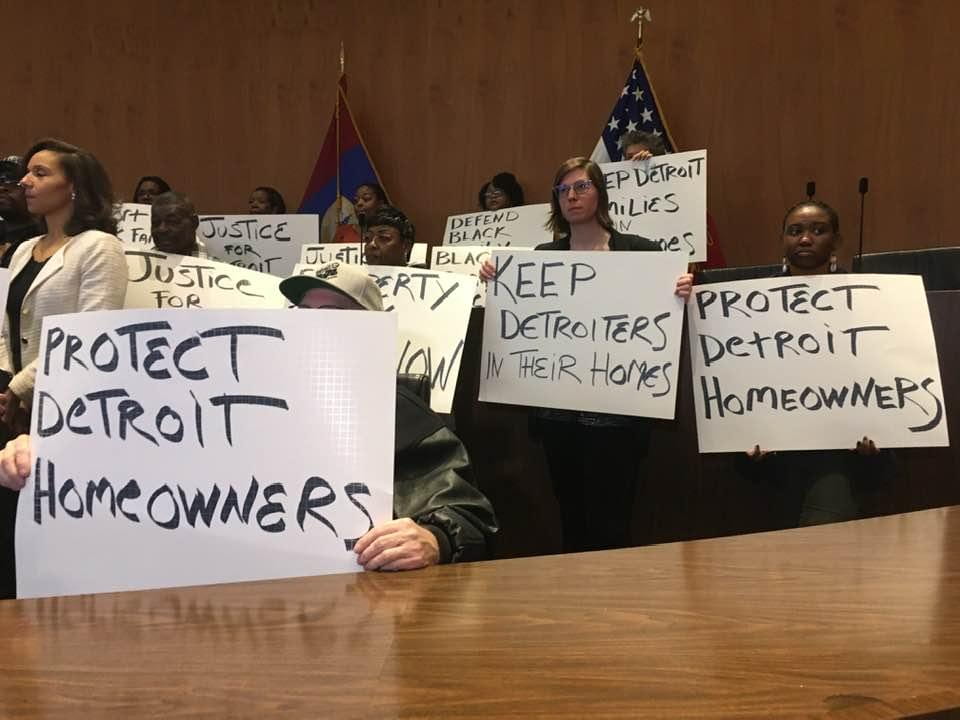

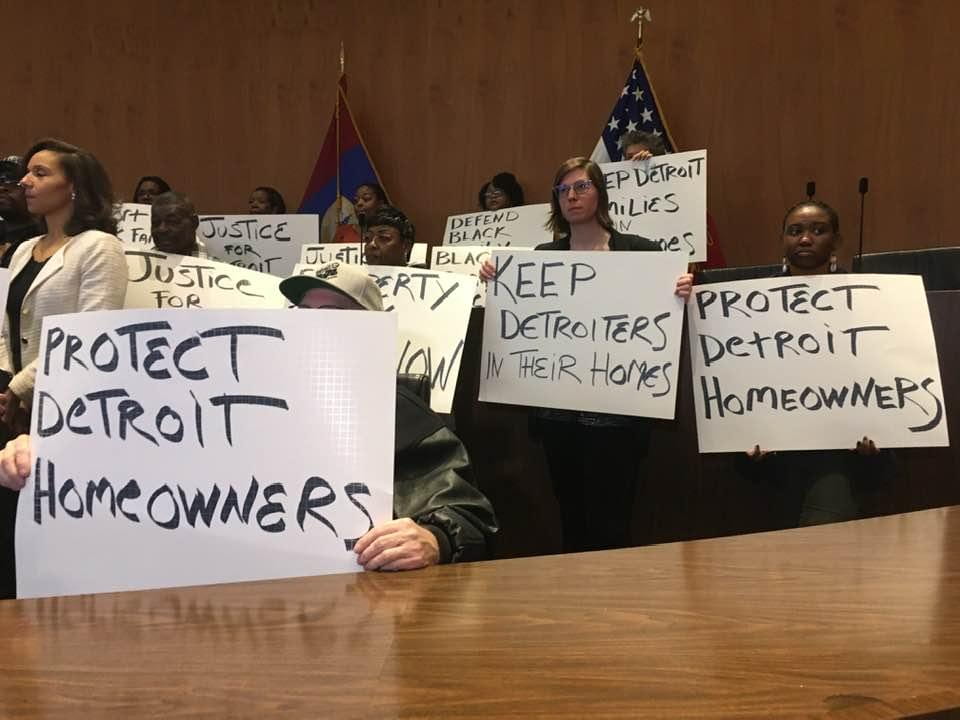

“A researcher cited in the lawsuit found that a quarter of Detroit’s lowest valued homes would now have gone into tax foreclosure had they been accurately assessed.”

by schmidt1 | Feb 14, 2020 | Property Tax News

“An across the board cut of assessments for all properties value $30,000 and under (University of Chicago professor Christopher Berry says he’s found the city continues to assess its lowest-value homes at inflated rates, even after the recent re-assessment)”

by schmidt1 | Jun 21, 2019 | Property Tax News

“And those inflated assessments contributed directly to Wayne County’s flood of tax foreclosures, according to new research by professors Bernadette Atuahene and Christopher Berry, published last week in the UC-Irvine Law.”

by schmidt1 | Aug 28, 2018 | Property Tax News

“In 2015, if you’d asked property tax expert Christopher Berry about the work he did for the Cook County Assessor’s Office, he would have said it was “a textbook example of how to do policy reform.”

by schmidt1 | Jul 13, 2018 | Uncategorized

“’There are usually standards involved,’ and entire sections of assessment textbooks lay them out, said Berry, a University of Chicago professor who helped design a new model for Berrios’ office that was never fully implemented.

When doing the hand-check process, analysts sometimes relied on data from internet sites like Zillow or Trulia ‘for insight into home characteristics’ — such as square footage and number of rooms — that can affect values. Berry said that’s problematic. ‘If they are doing that for one set of homes and not others, that’s going to introduce nonuniformity into the process,’ he said.”

by schmidt1 | Jun 8, 2018 | Property Tax News

“’Berrios issued a virtually identical press release in 2015, and it turned out to be completely false,’ said Berry, a longtime critic of Berrios’ assessment methods. ‘Why would anyone believe him this time? If they really have done what they claim, they should immediately release all their data and code for the public to see.’

Still, Berry said, dramatically higher assessments in booming areas of the city like Edgewater ‘could be an indication that the model could be getting more accurate. … It’s virtually impossible not to improve their model.’”

by schmidt1 | Mar 16, 2018 | Property Tax News

“’Everyone — even the assessor — now agrees that the system is regressive,’ Berry said. ‘But I wanted to know how much money is at stake. The answer is easily in the billions. These dollars are being taken from some of our citizens who can least afford it and used to pay the taxes of the wealthy. It’s unconscionable.’”

by schmidt1 | Mar 15, 2018 | Property Tax News

“The most valuable homes in Chicago were undertaxed by an estimated $800 million over a five-year period, with the bottom 70 percent of houses picking up the burden, according to a new report from the University of Chicago’s Center for Municipal Finance.”

by schmidt1 | Mar 15, 2018 | Property Tax News

“It is the first attempt to quantify the impact of well-documented disparities in the county’s assessment process, a topic that has dominated the re-election campaign of besieged Cook County Assessor Joseph Berrios. The report will provide more fodder for his two challengers, Fritz Kaegi and Andrea Ralia, who are trying to unseat Berrios in the March 20 Democratic primary.”