The Center’s Property Tax Project is cited in the New York Times

In a newly released study, the University of Chicago’s Center for Municipal Finance analyzed Detroit’s 2016-2018 assessment data. They find that — while the average home price was $35,600 — the majority of lower-valued homes (less than $19,000 sale price) were assessed in excess of the Michigan Constitution’s established limit. Due in large part to systematic overcharging, Detroit has one of the highest property tax foreclosure rates of any city since the Great Depression.

Data Scientist Eric Langowski presents the Center’s work at SatRday Chicago 2020

Langowski’s presentation regarding the Center’s R package and related code, and its use in our property tax evaluations, begins at minute 50:00.

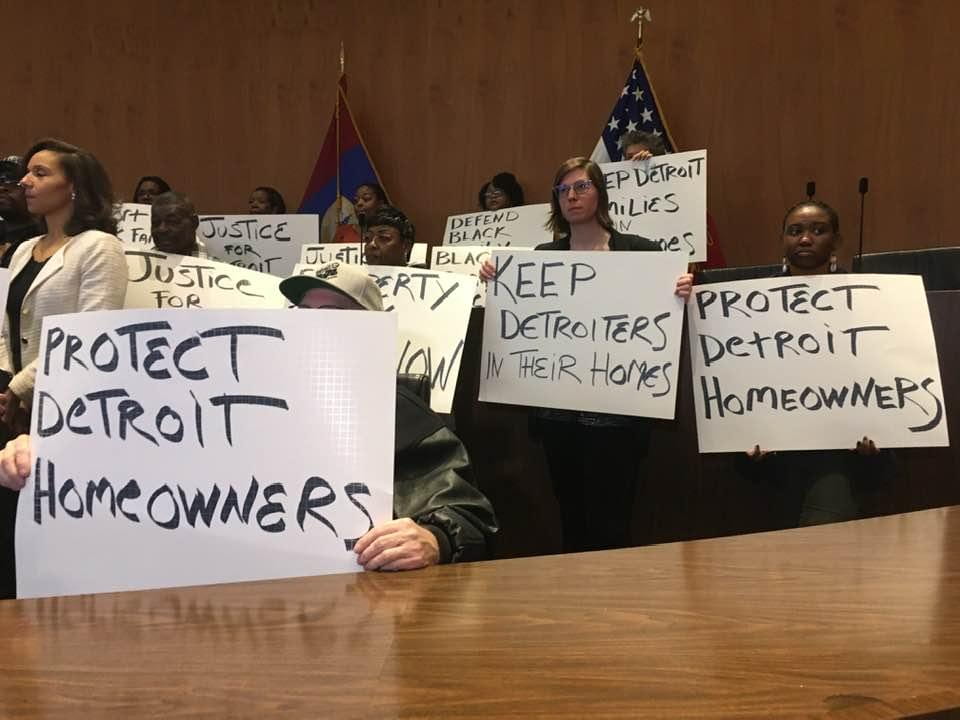

Professor Berry speaks to activists seeking end to tax inequities

“Christopher Berry, academic director for the Center for Municipal Finance and one of the study’s authors, said it’s unfortunate that the reappraisal did not fix the overassessments.

‘After having studied a lot of jurisdictions around the country, Detroit is not the only place that has this problem. But it is one of the worst that I’ve seen,’ Berry said.”

Professor Chris Berry speaks on the impact of the Center’s work in Detroit

“A researcher cited in the lawsuit found that a quarter of Detroit’s lowest valued homes would now have gone into tax foreclosure had they been accurately assessed.”

The Center’s work provides evidence for local legal action

“An across the board cut of assessments for all properties value $30,000 and under (University of Chicago professor Christopher Berry says he’s found the city continues to assess its lowest-value homes at inflated rates, even after the recent re-assessment)”